Wondering how to manage finances better this year? These proven strategies can help you take control, reduce debt, and build a stronger financial future.

Managing your money wisely can transform your financial health. If you’re looking for ways to improve how to manage finances in 2025, you’re not alone. Rising costs and unexpected expenses make it essential to plan carefully. Whether you’re new to budgeting or want better saving habits, this guide covers practical steps for smarter money management.

How to Manage Finances in 2025: Top Strategies for Financial Success

If like everyone else you are feeling the pinch lately then it might be time to sit down and work out your finances. Knowing where you stand financially will benefit you greatly, both in your personal life and work life. If you have never been great with money, and let’s face it, who is then there is help out there if you need it. Check out the article below to find out more on how you can manage your finances in 2025.

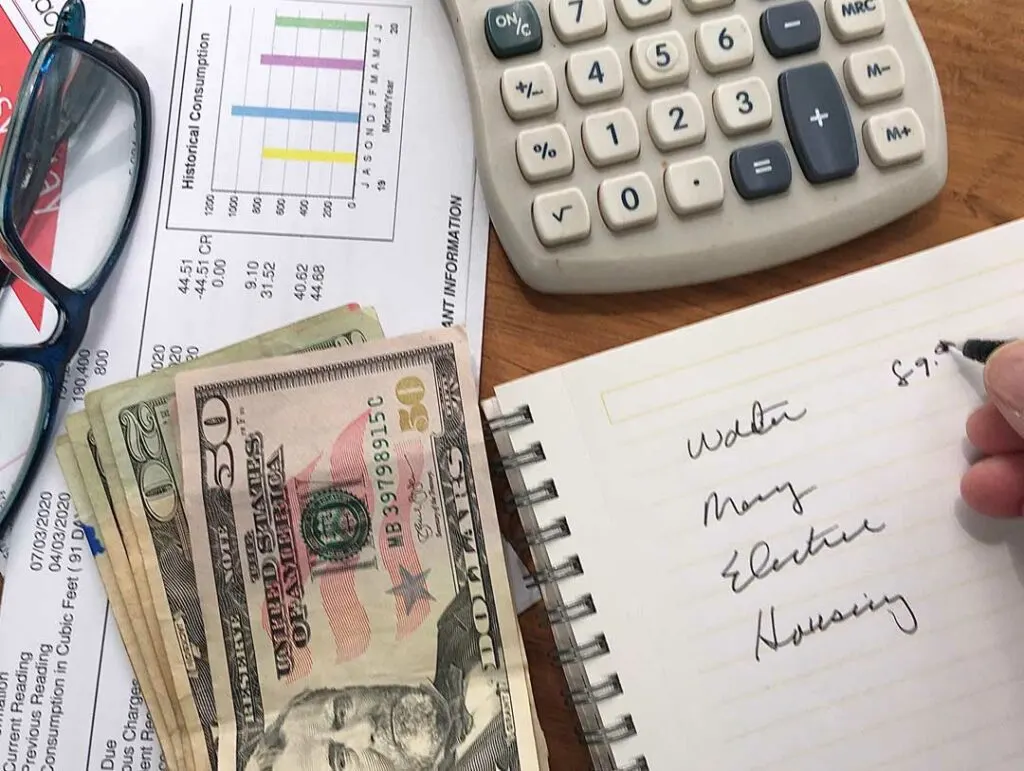

Create A Budget

One of the first things you need to do when managing your finances is set yourself a budget. This happens when you work out your incomings and outgoings then take the figure that is left over. For some, this might not be very much but something is always better than nothing.

Whatever is left can go towards savings or something that you have been waiting to buy. If you need assistance with your budget then there are calculators and forms online.

Save When You Can

Not everyone is in a financial position to save. However, if you have money left at the end of each week or month then put this away. This will be helpful for creating a rainy day fund

or holiday fund. Whatever you need the extra money for, work out how much you need and how long it will take you to save.

Pay Off Debts

If you have accrued debts over your lifetime then it is possible to pay these off. You could access various debt help schemes if you want to get a handle on it. They are very friendly, professional people who will go through all your options with you on how to pay it off.

Debt can build up from anywhere, potentially when you weren’t working but still trying to live or if you took out a few too many credit cards in your younger days.

There is no judgement when accessing debt help. It might be that you pay off a little each time towards individual debts or pay off one at a time. Whatever works for you and your budget.

Use A Financial Advisor

Another option to manage your finances and any money you have coming in would be to use a financial advisor. A financial advisor will take a look at your statements and salaries and see where you are overspending. They will give you tips and tricks on how to save and where to save.

Open A High Interest Savings Account

Lastly, if you have managed to save quite a bit of money then how about putting it in a high interest savings account. There is no point it just sitting there, when you can make money on existing money. How much you get in interest will depend on the percentage and how much you have saved.

High interest savings accounts are great if you are saving to buy something big like a house or a car. Check out which ones are around and the requirements to open one.

Master Your Money: How to Manage Finances in 2025

Learning how to manage finances effectively can change your life. By budgeting wisely, paying off debt, and saving consistently, you’ll build long-term stability and reduce financial stress. Whether you work with a financial advisor or handle it yourself, making proactive money decisions in 2025 ensures a brighter, more secure future.

Jessi is the creative mind behind The Coffee Mom, a popular blog that combines parenting advice, travel tips, and a love for all things Disney. As a trusted Disney influencer and passionate storyteller, Jessi’s authentic insights and relatable content resonate with readers worldwide.